Which have an expression financing, you get an upfront lump sum, which you up coming pay-off centered on a flat plan. Except for advanced schooling expenditures, USAA allows individuals fool around with their fund for virtually any purpose.

Well-known reasons for having taking out fully a consumer loan is combining user debt, appointment emergency costs or conducting remodels otherwise big family fixes. If you find yourself USAA wouldn’t combine your own loans to you personally, you can utilize the mortgage finance so you’re able to physically pay-off your own a fantastic debts.

A personal loan also may help when you find yourself faced with an emergency bills. Use the greatest disaster financing feedback to choose the right crisis lender to you personally.

USAA unsecured loans cost

USAA now offers competitive annual percentage cost (APRs) private financing, ranging from 7.85% in order to %. These prices are an effective 0.25% auto-pay dismiss. Even though many lenders fees loan origination fees ranging from 1% and you may 5% of the complete amount borrowed, USAA doesn’t charges mortgage origination charges. For a $100,000 personal loan, it indicates you can save doing $5,000 in the fees versus most other lenders.

Specific loan providers including charge a great prepayment otherwise very early percentage payment one to lets lenders recover some of the earnings shed in order to early loan payments. USAA cannot fees these prepayment punishment so you can pay-off the loan early in the place of adding to all round cost of borrowing from the bank. That said, USAA fees a later part of the payment equivalent to 5% of the skipped percentage count.

USAA signature loans economic balance

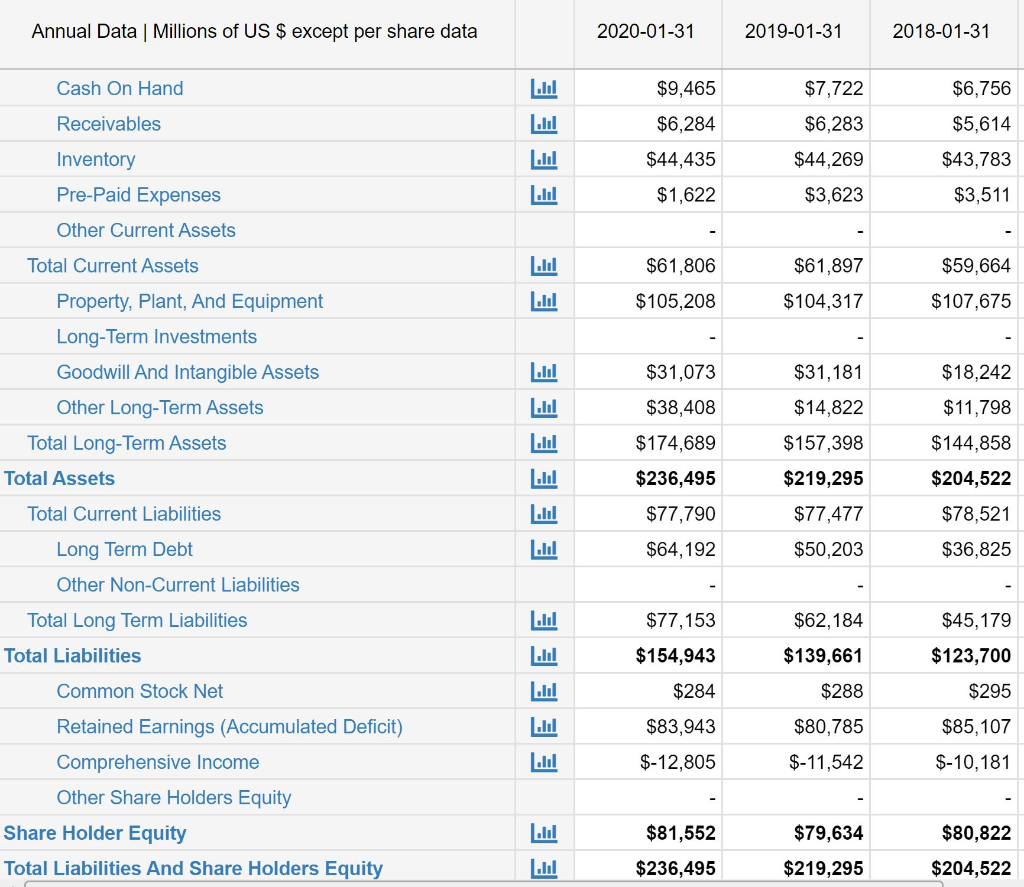

USAA is during zero risk of heading around any time soon – about maybe not based on credit rating department Have always been Better. They has just verified USAA’s monetary strength rating off A beneficial++ (Superior). Have always been Finest reach the score by exploring USAA’s equilibrium sheet sets, team methods as well as other facts connected with company longevity.

USAA personal bank loan access to

Applying for a beneficial USAA personal line of credit try a fairly easy process. Inside area, we’ll fall apart their likelihood of being qualified getting a personal loan, USAA contact info and you may product reviews off early in the day consumers.

Availability

USAA just provides signature loans to help you effective USAA members. When you are USAA does not publish specific standards for financing eligibility, you will have a credit rating with a minimum of 640. USAA get accept lower credit ratings, but reduced-qualified consumers need to pay high APRs. Your ount you desire. Don’t allow a credit history prevent you from taking right out an effective personal bank loan. Explore our self-help guide to an informed signature loans for bad credit to find the best financial for you.

USAA will even consider your earnings and you can obligations-to-money (DTI) ratio when researching the application. DTI merely divides all your monthly mortgage money by the monthly income. Such, if one makes $10,000 1 month as well as your monthly debt repayments full $step 3,000, then you’ve an excellent DTI of 29%. Lenders typically prefer borrowers just who manage a beneficial DTI from lower than as much as 43% when giving that loan.

Contact info

- An online representative chatbot

- A customer service line – 210-531-USAA (8722) – anywhere between 8 an effective.m. and you will 5 p.meters. CT Tuesday as a result of Tuesday

- Email from the USAA 9800 Fredericksburg Rd, San Antonio, Tx, 78288

USAA doesn’t list a customer support email toward the contact page. Although not, it retains social media profiles on Fb and you may Myspace, both of which happen to be obtainable by clicking on the proper symbols on the bottom proper-give place of one’s USAA website.

Consumer experience

Making an application for a personal bank loan are a somewhat small and you will simple techniques. Go into their USAA banking log in recommendations to your mortgage online webpage courtesy USAA on the internet and complete the application. According to USAA webpages, this step will be only take minutes.