Pros: Why you should thought a conventional financial

- You’ve got much more choice inside mortgages Conventional mortgages possibly have fixed-interest rates towards full term of the financing, otherwise Varying-speed mortgage loans (ARMs) with a first reduced repaired-interest as soon as the first several months is over, the interest rate have a tendency to to alter the 6 months. Fixed-interest rate mortgage loans aren’t incorporate fifteen-, 20-, and 30-season financing terms and conditions. It indicates the rate of interest will stay an equivalent to the amount of the mortgage, and you’ll have to pay from the mortgage along side agreed-abreast of big date. Adjustable-rates mortgages (ARMs) has an initial lowest repaired-interest in basic period of the loan. Once this basic months is over, the interest rate usually adjust all of the six months.

- You have got more control more than financial insurance When you have to shell out PMI, their PMI repayments often instantly end as soon as your household security is at 22%. House guarantee ‘s the difference between extent you borrowed from towards the property additionally the property’s newest I money, whether your home equity is located at 20%, you might pose a question to your bank to eradicate PMI out of your mortgage fees. Having said that, If you get an FHA loan to make a deposit out of lower than 20%, you will be needed to spend a mortgage advanced (MIP) for your amount of your loan.

- You could use extra money Whether your credit rating is over 700 therefore meet with the most other jumbo loan being qualified standards, you could potentially obtain around $step one.5M. Should your credit rating try over 740 and also you meet the almost every other jumbo mortgage being qualified requirements, you could potentially acquire around $3M.

Cons: As to why a traditional mortgage may not be right for you

- Your credit score try below 620. The fresh qualifications criteria having conventional finance be much more strict than simply regulators-recognized finance. Conforming loans can be purchased so you can Fannie mae or Freddie Mac computer in the future after being created to could keep mortgage loans sensible having homebuyers. Just after an excellent Fannie otherwise Freddie acquisitions that loan, the financial institution can use the money regarding the marketing to cover a great deal more mortgage loans. Although this is on the deeper a good of all homeowners, into the an individual height, if your credit rating are reasonable, some think it’s challenging to be eligible for a traditional financing.

- You’ve got a high loans-to-income ratio (DTI).Debt-to-earnings ratio ‘s the difference in their gross month-to-month earnings and you may the amount you need to pay for the debt monthly. For people who spent 1 / 2 of your own monthly earnings on the expenses and debt, their DTI would-be fifty%. Of many lenders does not approve a normal financial getting homebuyers having an excellent DTI more than 43%. On the other hand, FHA loans might be approved getting homeowners having DTIs around 50%.

- You have had prior bankruptcies and you will foreclosures. The new eligibility conditions getting government-supported mortgages are more relaxed. This means that, past bankruptcies and you may foreclosures was forgiven a lot faster. Homebuyers that have previous bankruptcies otherwise property foreclosure which will otherwise become accepted may prefer to waiting expanded before a lender approves all of them getting a normal mortgage. And in some cases, the brand new homebuyer’s financing may possibly not be accepted anyway.

How exactly to qualify for a traditional financing

*There might be specific exclusions to those standards needless to say transactions. A much better Financial Home Mentor can give more detailed recommendations customized on the unique resource means.

**Homebuyers exactly who have not possessed a home within the 36 months or even more, will be able to build an excellent step 3% advance payment to shop for just one loved ones property due to their number one quarters.

Speak about old-fashioned financing prices from Most useful Mortgage

Rates out-of every loan providers are influenced by brand new discount. The kind of possessions you might be to order, in which its discovered, along with your book financial situation together with affect the prices lenders offer. For this reason you can see a significant difference throughout the rates you will be given versus speed agreed to a pal. Will it is an individual’s credit history which makes the difference. https://paydayloancolorado.net/romeo/ Loan providers are more likely to give a lowered interest so you can homeowners that have a good credit score who would like to obtain more cash. Something else entirely loan providers account for is how likely and just how soon a borrower tend to refinance its financial.

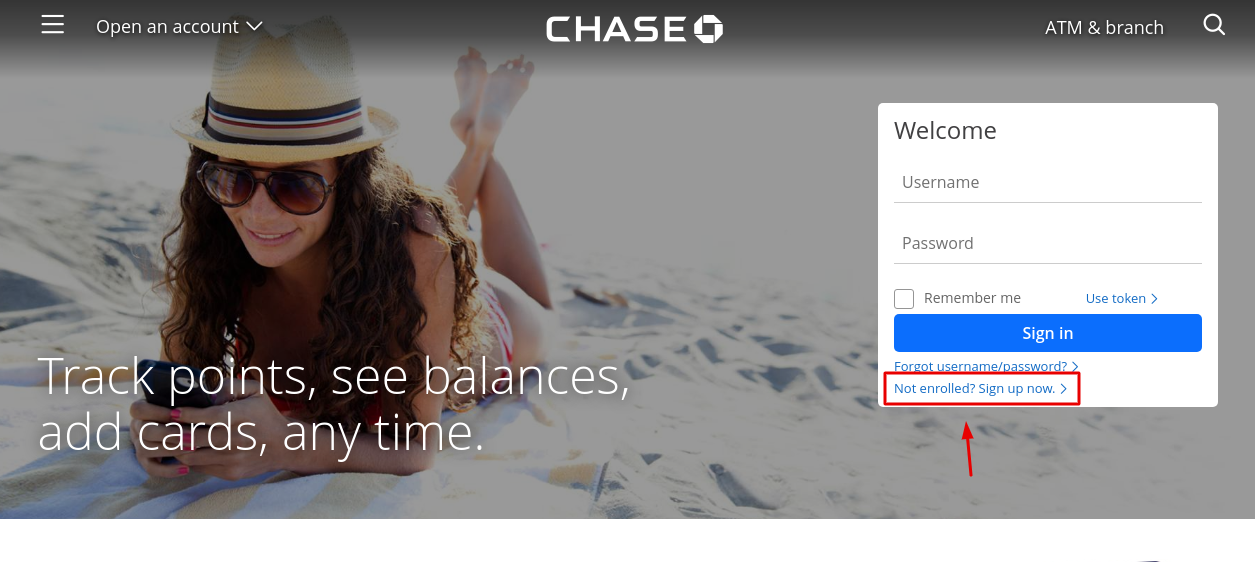

The quintessential perfect treatment for understand the personalized traditional financing prices would be to do home financing pre-approval. With Most useful Home loan, a good pre-recognition takes only step 3-moments and does not effect your credit rating.