Processing/Administration Payment – A charge billed from the a lender to cover the management will cost you of handling financing demand. For the analysis objectives, an operating otherwise management commission is recognized as being a lender payment.

Music producer Rates List (PPI) – Steps the average number of costs out-of a predetermined basket away from merchandise received from inside the no. 1 places from the producers. Monthly per cent change reflect the speed out of improvement in instance prices. Changes in the new PPI is commonly observed as the indicative off commodity rising cost of living. Frequency: monthly. Source: Work Agency.

Returns – An economic signal you to definitely steps new efficiency by the hour out of functions to have non-farm company development. May be used in conjunction with the price of change in Pit to choose if or not financial progress is likely to be inflationary. A separate parts actions unit work can cost you, a significant indicator out of coming rising prices. Frequency: every quarter. Source: Work Institution.

Property Taxes – Taxes in accordance with the assessed worth of the house, paid down by the resident for people attributes for example schools, social performs, or other costs away from state government. Possibly paid as part of the month-to-month mortgage repayment.

Market – A meeting at the a beneficial pre-announced public destination to offer assets to get to know a mortgage you to definitely is actually standard.

Personal Record – A set of courtroom data which can be submitted with the regional authorities registry so that the societal know just what liens, encumbrances or judgments make a difference people little bit of a property.

Buy Arrangement – An authored deal signed because of the buyer and seller saying the fresh new small print significantly less than and therefore a property will be offered.

To find Executives Connection from Chi town (PMAC) Survey – The new PMAC Survey try a composite diffusion directory out-of development standards on Chicago city. Indication more than 50% imply a growing warehouse field.

Quadrangle – A rectangular-designed belongings area, 24 kilometers for each top. Frequently used regarding bodies rectangular survey type of residential property description.

Accredited Experienced – So you can theoretically determine if you are find out here an experienced seasoned, your otherwise Virginia Borrowing Union need certainly to request a certificate regarding Qualification (COE) about Virtual assistant. So it certificate demonstrates that the fresh new Virtual assistant provides calculated you are eligible getting a Va mortgage and you will reveals the amount of available entitlement otherwise warranty. To obtain a certification regarding qualification, complete the Ask for a certification off Qualifications getting Virtual assistant Financial Gurus Form (Va Mode 26-1880) and you may complete it toward Va. virtual assistant.gov).

Qualifying Percentages – Computations did of the loan providers to determine your capability to settle a great loan. The original qualifying ratio are computed of the breaking up the month-to-month PITI from the gross monthly money. Next ratio is actually computed because of the separating new month-to-month PITI and any monthly expenses by terrible monthly money.

Qualifying Thrift Financial – A loan provider who focuses primarily on home loan financing within the guidelines created from the Creditors Change, Recovery and Enforcement Work (FIRREA)

Quitclaim Action – A deed one transfers, in place of warranty, whichever focus otherwise rights a great grantor possess at that time the new import is done. Tend to accustomed cure a prospective cloud on the title.

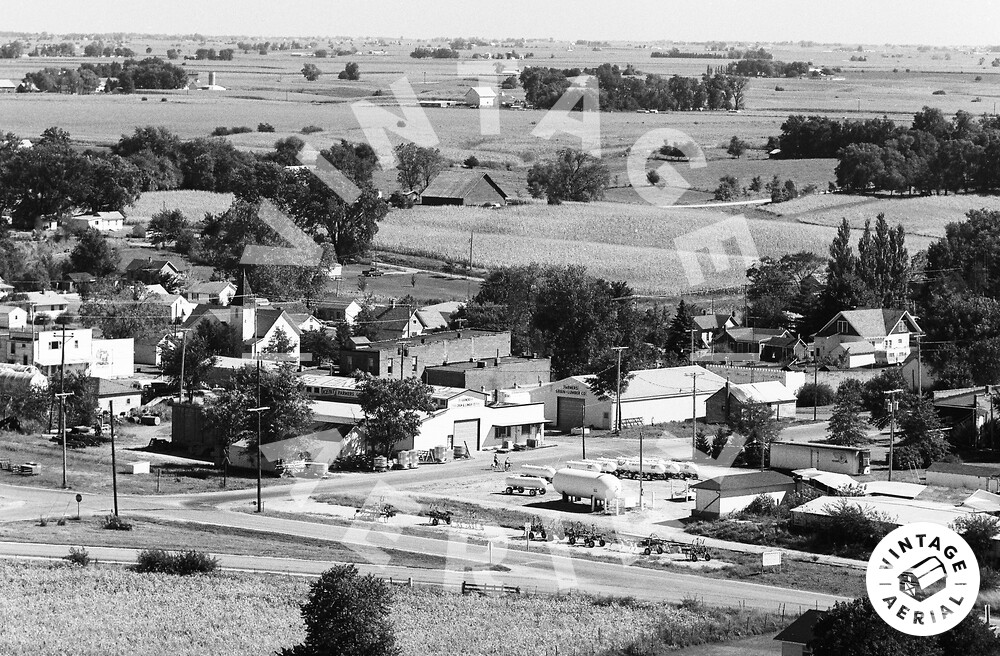

Farm House – After described a decreased, one-tale house typical of one’s west You. The expression is now accustomed determine almost any you to definitely-story house.

Rate Improvement Mortgage – A fixed-rates financial (FRM) complete with a clause making it possible for this new borrower the possibility to minimize the pace single (as opposed to refinancing) from inside the first couple of many years of the loan label

Speed Transform Cover – The absolute most one to an interest rate can change, possibly within a modifications months or higher the whole longevity of the fresh new loanmonly of this a variable price home loan (ARM).

Qualifying Thrift Financial – A loan provider who focuses primarily on home loan money beneath the guidelines created from the Loan providers Change, Data recovery and you can Enforcement Operate (FIRREA)