After you have started prequalified otherwise preapproved and you may learn your financial allowance, you could begin interested in a home that fits your position (and finances). You may also discover a real estate agent who’s got expertise in business trend as well as the area you want to to pick from inside the. They may be able make it easier to assess comparables in the area and work out a competitive give. Remember that because you have been prequalified or preapproved getting good specific amount does not mean you have to max out your finances.

Credit cards & Short-term Owners

While the a temporary resident, you can constantly availableness handmade cards and you may mortgage facts provided that as your immigrant reputation are a temporary foreign staff member and also you keeps a valid functions allow and you will SIN matter you start with nine. Really lender’s standards will need you to has about 1 year kept on the Canadian works permit in order to qualify. The financing credit and you may financial options are similar to that from beginners which have permanent citizen updates.

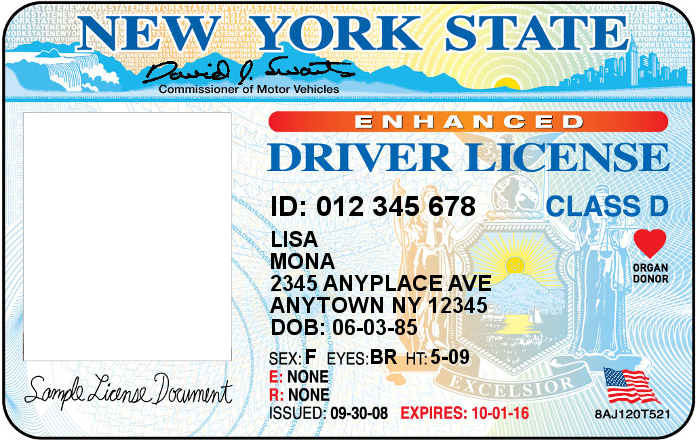

Apps such as the Scotiabank StartRight System create short-term citizens to gain access to playing cards and you will mortgage loans when they meet with the qualification conditions. So you can qualify for a charge card, you desire work allow, one a lot more bit of regulators photographs ID including a passport or Canadian driver’s permit, and, when you’re as well as obtaining a credit card, a page out of your employer in the Canada stating their yearly money.

Insights Canadian Credit score

Understanding the importance of with a positive Canadian credit score are crucial that you keepin constantly your economic fitness. Of numerous situations one to sign up for good credit are considered.

- Fee history: This can be an entire writeup on all sorts of borrowing account and just how you’ve addressed borrowing from the bank in earlier times. They solutions a lender’s question of whether or not you have made timely payments and you will treated the debt responsibly. Percentage record will also give information on if or not you have got actually ever missed repayments or become delivered to a portfolio service.

- Utilized borrowing compared to. offered borrowing: This might be also referred to as borrowing $255 payday loans online same day South Dakota use that is a ratio you to definitely tips the degree of credit you have used than the your readily available borrowing limit. You could calculate this because of the splitting their total borrowing from the bank balance from the their total borrowing from the bank limitations and you will multiplying by the 100. Endeavor to maintain your borrowing usage at the or below 31% to maintain and you may change your credit score. You possibly can make finest use from the requesting the greatest maximum you are able to and recognizing one preapproved limit expands out of your credit card issuer. Just remember that , your maximum harmony in any provided month should never surpass a 3rd of the restriction.

- Borrowing blend: This is actually the different types of borrowing from the bank levels you have, including credit cards, finance, and you may mortgage loans. With a varied mix of borrowing helps you alter your credit history. It is simply as vital to make use of this borrowing from the bank for the a great consistent basis since it is to get it in the first set.

- Amount of credit score: Here is the timeframe which you have got credit. The brand new prolonged you have got had credit, this new longer their records could be, that may dictate your overall credit score. Avoid closing playing cards. For people who must rating a new bank card with the exact same issuer, make them turn it instead of closure they and you can implementing getting an alternative one to.

Your credit report shall be pulled from 1 of one’s revealing businesses within the Canada, Equifax or TransUnion, or accessed complimentary regarding very creditors in the Canada. A credit report have a tendency to consist of information about your credit services your financial history in the Canada. A top credit rating may present extra savings on the house otherwise car insurance.