The soundness of your own repo speed indicates that banking institutions aren’t likely to make alter on their financing rates.

Repo rate undamaged: The Reserve Lender of Asia (RBI) decided to hold the key repo speed undamaged in the 6.5% to your 11th day through the the economic policy comment towards the Monday. Here is the 11th successive choice to maintain the present day price, offering no instantaneous relief for individuals with lenders. This is why, possible homeowners can get mortgage interest rates to stay at an equivalent peak for the time being.

MPC believes you to just with strong https://paydayloansconnecticut.com/staples/ price balances do we secure a powerful basis for highest gains. MPC is actually invested in fixing inflation-gains equilibrium in the interest of the discount, RBI Governor Shaktikanta Das said.

The stability of repo rate suggests that finance companies commonly anticipated to make any transform on their financing prices. Consequently, the equated monthly obligations (EMIs) are likely to are nevertheless regular for the present time.

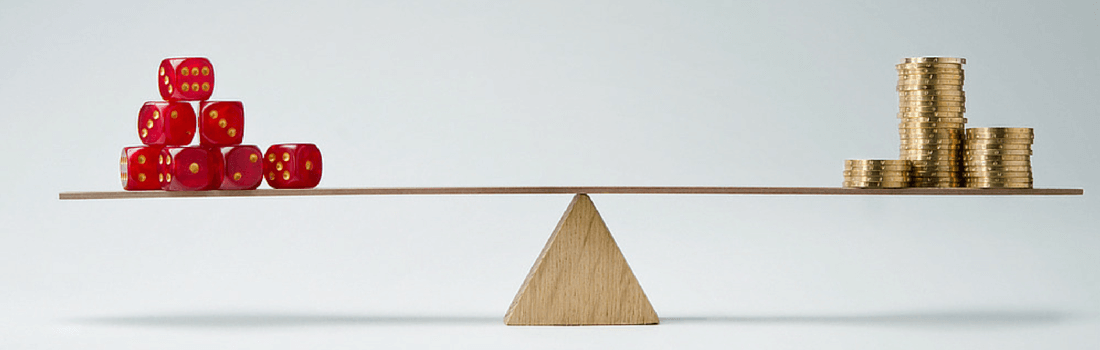

The fresh repo rate, influenced by the latest Set-aside Bank from Asia (RBI), takes on a life threatening character from inside the determining the attention cost to own house financing all over the country.

It choice comes in the fresh wake off India’s real GDP growth decreasing so you’re able to a beneficial eight-one-fourth low of five.4% from the ong economists. This new RBI continues to prioritize the brand new reduced amount of merchandising rising prices so you can 4%.

Away from forward, banking companies has actually tied up drifting-rate merchandising financing particularly mortgage brokers so you can an outward standard, typically the repo speed. This means that one alterations in this new repo speed personally affect the interest cost on these loans. Individuals might get away from price cuts, however, sustain the newest brunt out of improved appeal will set you back in the event the repo rates try increased.

“Having India’s GDP projected to enhance between 6.5% and you will eight% in the FY 2024-twenty-five, as well as the a home sector adding 7% for the savings, keeping balance is crucial to preserving monetary impetus,” said Manju Yagnik, vice chairperson out-of Nahar Group and you may elderly vice-president off NAREDCO Maharashtra.

RBI repo price undamaged: Homebuyers will have to waiting till 2025 getting recovery to the financing EMIs

For folks looking to purchase a property, steady interest levels imply that its month-to-month mortgage payments will stay constant to the foreseeable future.

“A steady rate guarantees predictable payment conditions, and this boosts visitors trust and you can encourages capital throughout the markets. Having rising assets cost, steady lending standards enjoy a pivotal part in the driving home growth, adding significantly in order to India’s cost savings,” additional Yagnik.

Shishir Baijal, Chairman and Handling Director, Knight Honest India, said: “A speeds slashed could well be a pleasant move for users, especially home buyers, as credit can cost you remain increased in spite of the undamaged repo rate. Development in lenders has actually slowed down, and application one of straight down-earnings organizations provides dropped somewhat, because observed in the newest sharp lowering of reasonable construction transformation.”

The guy additional the new RBI is wanting so you can equilibrium multiple pressures including good depreciating rupee, softening thread productivity, chronic rising cost of living, and you will a lag within the gains.

“Due to the fact progress lag isn’t stunning yet ,, it includes the fresh RBI enough room to save prices constant while the they centers on dealing with inflation and stabilising brand new currency. The RBI’s shift to the a basic stance tips within a slow rotate regarding inflation control to help progress.

Dhruv Agarwala, Class Chief executive officer, Casing & Proptiger said: “The newest RBI’s decision to keep the new repo rate unchanged reflects its issues over rising cost of living, despite lower-than-expected growth in new September quarter. Which have housing affordability under pressure because of rising property pricing, a speeds reduce might have raised the a house market, including amidst slowing metropolitan consult and you can moderation inside the salary gains. Yet not, homes request remains strong, especially in new higher-stop and you can luxury avenues, with most this new releases in the December quarter centering on these types of groups. Targeted measures, such as changes on Dollars Put aside Ratio (CRR), is inject exchangeability so you can sustain which energy.”