Toward face from it, this seems like a not bad idea. Whatsoever, you’re taking a lot of taxation-deferred money, then using it to fund a great Roth IRA, that is taxation-100 % free. Here are a couple away from factors:

step 1. As to the reasons was not good Roth element of your using means in the first place? Anyway, Teaspoon account you should never build that higher overnight. When you’re and work out a rapid transform simply because you need money in your Roth membership, you might imagine why.

Although not, if you find yourself in a high small loan companies Libertyville tax class, next foregoing the fresh income tax deferral toward coming Tsp efforts (because the you may be paying down their Teaspoon membership with after-tax cash) will not make sense. You might be fundamentally offering their tax benefit by using just after-income tax currency so you can refund your self. Only use brand new shortly after-income tax benefits to cover their Roth IRA and then leave your own Teaspoon to grow taxation-deferred.

Whatsoever, you’re going to pay back that loan which have immediately after-tax bucks, therefore, the websites effects could well be fairly equivalent as if you just been causing the new Roth IRA before everything else

Conversely, whenever you are into the a lesser income tax bracket, then you might be better off performing a good Roth conversion. If you a how to go ahead of breakup otherwise later years, you might think doing this from a vintage IRA. If you have a lot of money disperse, next max aside Roth Tsp and you may a great Roth IRA both for you and your partner.

2. What exactly are you probably invest in towards the Roth IRA which you cannot manage inside Tsp? Before-going any further, it’s best to know what might buy. If you are looking so you can broaden the profile, you may want to definitely know very well what you’re going so you can broaden toward. This way, you aren’t simply spending more money to purchase ton of directory funds who do the exact same thing you to definitely Tsp do.

Because of some unexpected costs its skeptical that my spouse and that i will be able to maximum aside each other our old-fashioned 401ks and Roth IRAs. We set increased well worth for the fully resource the Roth as i plan to retire by the age 50 and you can discover that individuals normally detachment our benefits without penalty until we hit 59.5. All things considered, I would like to continue to max aside our 401ks as income tax advantaged space should not be leftover on the table.

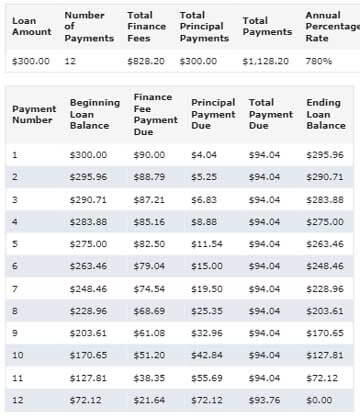

My personal imagine is to try to take out a 1 year $eleven,000 Teaspoon financing during the dos% by the end of the year to fully fund all of our Roth IRA when you are still maxing aside our very own 2015 401k tax advantaged place

The new options are to keep the money in the brand new 401k and forfeit investment the new Roth IRA this season or to somewhat eradicate the latest Teaspoon/401k efforts and neglect to maximum aside in 2010. Excite explain just how possibly ones solutions surpasses my personal suggestion.

step 1. Tend to these types of expenses decrease ranging from now and then seasons? Maybe. When it few was dutifully maxing aside each other membership, so there is actually an emerging you to-big date debts, this may seem sensible. Although not, they might need the cash flow to repay the newest Tsp mortgage and you may max away the financial investments next season.

2. May i finance its Roth IRAs the coming year? The fresh new deadline having Roth IRA share is actually the latest income tax go back deadline. To have 2017, the latest Roth IRA contribution due date are (income tax big date falls on the 2nd working day immediately following vacations and you can holidays). When it partners is really earnings self-confident, I’d alternatively find them use the basic five months of the the following year to pay for the newest 12 months Roth IRA, after that max from following the year’s share.