During this seeking to date, we thanks for assuming First Community Bank to assist procedure your PPP financing with the Business Government (SBA).

The newest reputation lower than are the really impactful changes into the PPP loan forgiveness requirements and processes that we would like to high light for you. Once the new information is mutual, we’ll post it right here for your resource.

April 20 th Revise

For many who put your Salary Safeguards (PPP) providers mortgage to blow eligible costs within the safeguarded period, you could potentially make an application for financing forgiveness as long as the borrowed funds has never grow.

If you do not apply inside ten days pursuing the last day of the fresh safeguarded several months, the loan money won’t getting deferred while have to start making repayments.

February 10 th Posting

New SBA create new forgiveness applications to own earliest mark PPP borrowers into February 5. The new application to have consumers which have loans regarding $150,000 otherwise reduced needs less computations with no files.

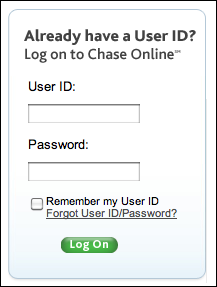

The new up-to-date software come in all of our forgiveness system you need to include people data stored inside a previous application. To access or resume your updated software, merely get on the forgiveness platform with the subscribed signer’s email address, company TIN, and private SSN.

We remind one to get loan forgiveness as soon as you’ll be able to. In case your application is over and able to feel submitted to the newest SBA, please get a hold of Fill out to have Remark after the program.

December nine th Posting

Once we approach the end of the year, you want to continue to encourage consumers who’ve not even already been a beneficial forgiveness application to achieve this as soon as possible.

Just like the an indication, individuals having loan amounts of $50,000 otherwise less might possibly be defaulted to your this new SBA Easy Application which includes less studies sphere to accomplish but still need an identical amount and you can quality of help paperwork.

If you have questions about your mortgage forgiveness software, please be at liberty to arrive off to the bank.

November 16 th Up-date

We have now had multiple website subscribers effortlessly finish the forgiveness techniques and also as way more consumers prepare add forgiveness apps, we wish to show a couple of things we have read assured of creating the process easier for all individuals.

- The debtor completing the newest SBA application towards the bank’s electronic system

- The bank carrying out a look at the application form and you can help paperwork

- In case the remark works, the lending company submitting the applying additionally the supporting data files on the SBA

- This new SBA getting feedback to your app that the bank following relays on the borrower. The fresh views regarding the SBA is normally completely forgiven, partly forgiven, need addiitional information, or the application form was in the process of then opinion of the SBA

- Individuals having EIDL improves and you will EIDL money (obtained right from the newest SBA) is to meticulously review brand new EIDL and you will PPP rules and you may just remember that , EIDL enhances was subtracted throughout the forgiveness application of the SBA. Oftentimes, the SBA will head the financial institution to deduct EIDL enhances from new forgiveness number, and this number have to be repaid of the debtor in the event that the guy/she as well as gotten good PPP loan.

- Consumers should think about leveraging the alteration from inside the forgiveness attacks from the submitting programs one to make the most of the full time available (24 months instead of the original 7 months) while increasing the complete forgiveness amount. We come across individuals fill out software in accordance with the 7-few days timeframe you to definitely led to a balance on the debtor. 20000 dollar installment loan Had the debtor utilized the full 24 weeks, they will have obtained 100% forgiveness.