The present day domestic equity mortgage costs inside Maryland to own 10-season money average 7.7%, matching the fresh new federal speed. To have fifteen-12 months funds, the common price try eight.9%, and that is aimed towards federal mediocre.

From the Zachary Romeo, CBCA Analyzed because of the Ramsey Coulter Modified by Lukas Velunta Because of the Zachary Romeo, CBCA Analyzed of the Ramsey Coulter Edited by the Lukas Velunta On this Page:

- Newest MD HEL Rates

- MD HEL Prices by the LTV Ratio

- MD HEL Prices because of the Urban area

- MD HEL Lenders

- The way to get an educated HEL Rates

- FAQ

loans for bad credit in Lester

The brand new equity in your home as you are able to accessibility and acquire is named tappable guarantee. A house equity loan (HEL) can help you maximize your home guarantee, regardless if you are looking to funds home improvement ideas or consolidate obligations.

Maryland’s home security mortgage rates take par that have federal averages – eight.7% Apr getting an effective 10-12 months identity and you can 7.9% Annual percentage rate to possess a great fifteen-seasons label. We have compiled detail by detail understanding towards current home guarantee loan rates in the Maryland, along with city-particular pricing, top loan providers, and you can advice on protecting an educated cost for making use of the residence’s security.

Trick Takeaways

Higher LTV percentages bring about highest pricing. The common Apr for an effective 15-season HEL within the Maryland which have an enthusiastic 80% LTV is eight.7%, than the 8.2% getting a good ninety% LTV.

HEL cost vary because of the urban area in the ple, for fifteen-seasons money, Pocomoke City provides the common Apr out of 6.0%, whereas Berlin’s is actually 10.7%.

Other loan providers render varying pricing for the very same financing designs. Baltimore State Professionals Government Credit Union’s mediocre Apr was 5.4%, while Spectra Federal Borrowing from the bank Union’s is actually several.5%.

MoneyGeek checked-out 55 different finance companies and you can borrowing from the bank unions for the Maryland using S&P Global’s SNL Depository Pricing dataset to remain latest for the current house security financing costs.

The present day mediocre Apr to possess an effective 15-seasons house collateral financing during the Maryland try eight.9%, but numerous issues might affect just what lenders bring. A high credit rating can lead to a lower ount you’ll increase it. Fees terminology as well as contribute to choosing cost. Discuss the brand new table evaluate an average APRs regarding domestic security funds for the Maryland across the additional loan terminology.

Rates of interest getting a home security mortgage transform each day. Observing these transform can help you spend less during the appeal over the fresh loan’s lives, helping you save money. Positive rates in addition to make funding home improvements economical, boosting your house’s really worth.

Including, an effective fifteen-seasons $50,000 house guarantee mortgage with an excellent seven.9% Apr contributes to a payment away from $475 and you will a complete attention out of $thirty five,490. However, an effective 10-season financing that have an effective eight.7% Apr possess a payment per month from $599 and you can complete interest off $21,849.

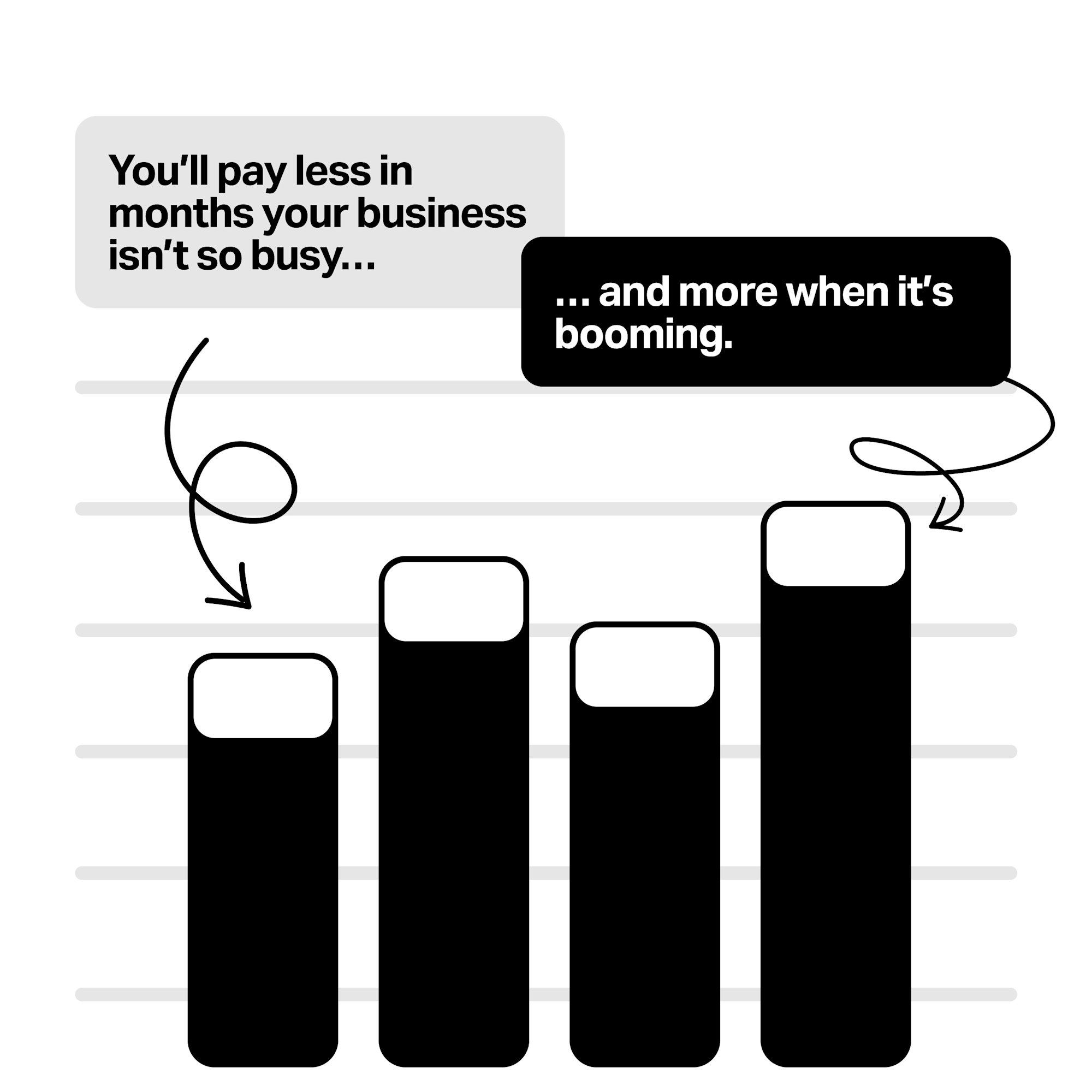

House collateral finance and you can home equity lines of credit (HELOC) is actually well-known choices for property owners so you can utilize the home’s guarantee. Family security fund have repaired prices, averaging eight.6%, while you are HELOC rates for the Maryland are adjustable, averaging 8.2%.

Fixed prices indicate your monthly obligations remain consistent, offering monetary predictability. On the other hand, adjustable pricing can start all the way down but can boost, resulting in higher costs throughout the years. Understanding how these types of rate structures performs can help you make better economic conclusion.

Family Guarantee Mortgage Cost because of the LTV Ratio

The speed you qualify for utilizes the loan-to-value proportion, which measures up your home loan harmony into the residence’s appraised worthy of. To calculate their LTV ratio, divide your existing financial harmony by your house’s appraised worthy of and you can proliferate by 100. For example, in case your house is cherished during the $3 hundred,000 while owe $240,000 on the mortgage, the LTV ratio is actually 80%.

A higher LTV ratio mode better prospective chance so you’re able to loan providers, causing large costs. Currently, the average Apr from a good fifteen-season collateral financing inside Maryland that have a keen LTV ratio out of 80% is actually seven.7%. It’s 8.2% for a keen LTV proportion away from 90%. Utilize the table below to see just what costs you could potentially qualify having based on their LTV proportion and you can evaluate mediocre home equity financing rates.