He centered Cenlar’s Transfer Functions, Client Management and you may Company Innovation groups, and that’s responsible for all Providers Invention issues. He oversees Transformation, Consumer Management, Business and you will Business Telecommunications. He functions as a member of the brand new Panel out of Directors from Cenlar Financial support Corp., which can be an active person in the fresh new American Bankers Association’s Financial Markets and you will Technical panel, a person in the borrowed funds Lenders Connection, and you will prior president of one’s New jersey Category out of Society Lenders.

This new atically over the past 2 years. Which have rates now more than 7.5%, the fresh refi increase enjoys all but dried out. On the other hand for home owners, the borrowed funds Lenders Association stated that the new delinquency rates at avoid of the one-fourth transpired to 3.64%, the reasonable as his or her questionnaire first started from inside the 1979. Besides are delinquency off, however, property foreclosure and you can bankruptcies try off, too.

Domestic Security Credit lines are getting a far more viable product to own property owners. If the a homeowner refinanced over the last a couple of years, it probably refinanced down seriously to a great 3% or 4% interest rate. They won’t have to promote one to up-and transfer to a great high rate of interest. In the event that money is needed seriously to upload a child to school otherwise get a unique automobile, the way following are, often, to go so you’re able to a HELOC.

Originators try ramping right up their HELOC efforts to stay competitive for the the business despite the new analysis off an ever-altering regulating ecosystem loans Indian Springs Village AL. Very loan providers that are either originating financing, repair funds, or creating each other, need contemplate simple tips to provide such HELOCs while nonetheless keeping the brand new regulatory and you may conformity loans. A lot more originators will look to utilize servicers which have the fresh solutions to handle the latest regulatory and you can conformity criteria, that’s let me tell you the quintessential critical factor to adopt when choosing an effective servicer.

Controlling the chance with good HELOC is not any distinct from a great mortgage. But there is however a higher chance of con that comes with an open credit line eg a great HELOC. A good servicer need a robust identity theft & fraud protection system when you look at the spot to assist detect any uncommon pastime for the HELOC levels.

The newest business economics with the Financial Upkeep Legal rights have increased, and it’s really started an effective possible opportunity to profit from the brand new change in opinions. These types of MSR opinions promote an income stream that can help so you can offset will set you back in order to maintain the technology and you may administrative structure designed to create the newest re-finance growth you to definitely taken place in the last a couple of years.

Financial lenders got a good opportunity to hold, maintain and you may earn to your MSRs it held. Considering the options of these mortgage lenders in order to exchange aside the portfolios, servicers have likewise knowledgeable loads of pastime transferring mortgage profiles ranging from providers and customers for the past year. In the past, there is viewed financial lenders promoting for tax intentions, generally speaking to yearend, that is a variety of a natural purchase for the majority of. Today, it’s getting more opportunistic positions within the last seasons.

David Miller brings forty years of expertise to Cenlar within the proper considered, mortgage repair functions, enterprise administration and you will accounting and you will servicing possibilities

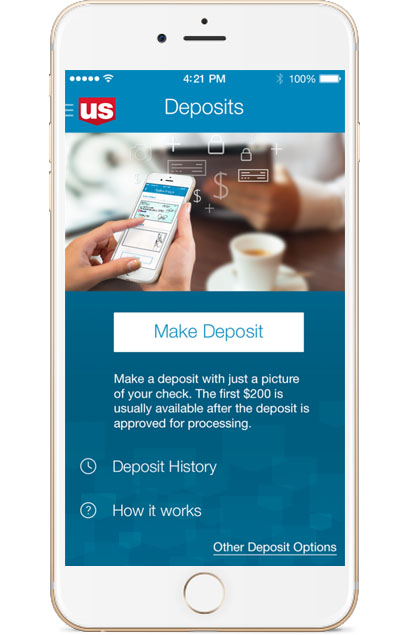

Mortgage brokers and you may servicers continues to spend money on technical in order to provide the finest customers feel to have homeowners to ensure an effective a whole lot more customized, frictionless and you can proactive correspondence. Self-service systems, such bots and other electronic gadgets would be available to property owners which search smaller solution and you can genuine-date reputation to compliment the customer feel.

For example, on Cenlar, i always make improvements to the electronic front side. We have changed our very own Entertaining Sound Response system to let homeowners who e mail us remember that they’re able to care about-suffice any moment on the internet site. And you can our spiders enjoys reinforced our mind-serve choice, which have typically 108,000 homeowner relations monthly approximately 80% away from home owners whom get in touch with a bots no longer need consult with a live associate. Also, get together analysis to analyze homeowners’ relations usually are designed to sharpen inside on cause away from customer grievances. Using Fake Cleverness, such, can help give insight on what the new homeowners’ discomfort points are to increase the resident journey.

The brand new mortgage design have fallen out of which can be off of the several-thirds from the beginning out of 2022

These are a number of the styles we have been enjoying. And even though we do not keeps a crystal ball to see brand new coming, we are going to continue steadily to view the fresh advancements in the business.