seventh Peak Mortgage makes it much simpler so you’re able to be eligible for 100%, No money Down USDA loan programs inside the Nj, Ny, Pennsylvania, Virginia, Maryland, Tx, Fl, Texas and you may Kansas!

USDA Rural Creativity real estate loan loans are specifically built to let low in order to modest income property and first-time homebuyers pick land during the USDA eligible outlying components. seventh Level Mortgage now offers USDA loan software that can be used buying a preexisting domestic, build a different sort of family from abrasion, or generate solutions or renovations so you’re able to a preexisting USDA eligible outlying property. These types of money could also be used to switch liquid and you will sewage options on the rural assets, if you don’t used to move in a home entirely. USDA home loan apps are available in every state 7th Top Home loan is actually subscribed to do home loan credit also Nj-new jersey, New york, Pennsylvania, Virginia, Maryland click to read more, Tx, Fl, Texas and you may Ohio. General qualification direction with the program are identical during the all of the condition, not for every county according to earnings and population thickness. Thankfully that if you require a home mortgage out-of seventh Level Home loan in one single both New jersey, New york, Pennsylvania, Virginia, Maryland, Tx, Florida, Tx and you may Kansas extremely areas during these states meet the requirements!

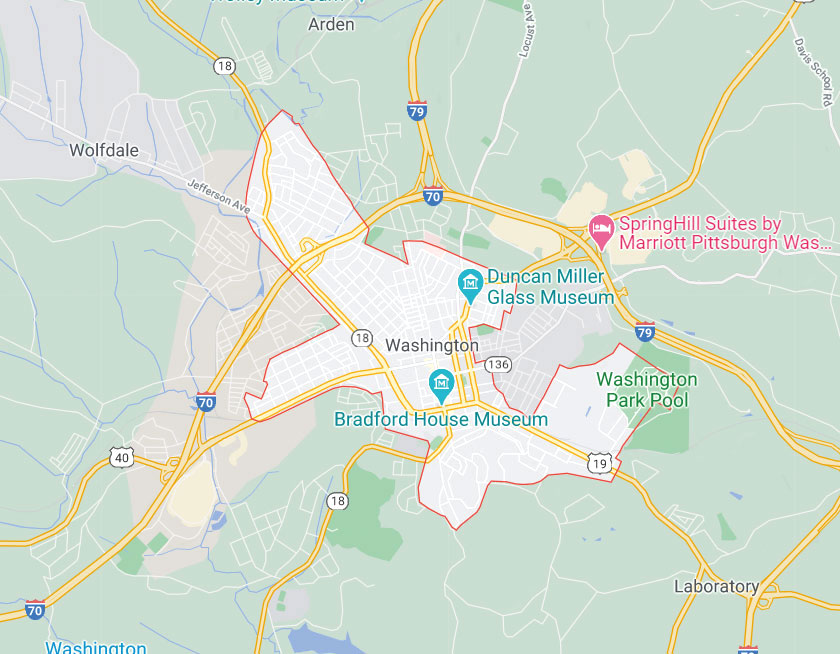

USDA Qualified Portion

Whenever you are selecting an effective USDA house, the next thing is to find out perhaps the domestic your looking to buy is now in a good USDA qualified town. USDA qualified elements range between one state to another and are generally calculated according to a number of different issues. To possess a place become USDA eligible it must be found when you look at the an outlying city. Brand new USDA talks of a rural area because the people town that is rural in general and is not section of otherwise of the a city, otherwise any city, community or urban area possesses lower than 10,000 citizens. Almost every other less outlying portion outside of big population facilities that have a great serious decreased home loan credit could possibly get qualify that have populations ranging from 10,000-20,000 people. All of these section will most likely not even be rural in general, but have populations out of lower than 20,000 and generally are not on the one big area otherwise towns and cities.

USDA Income Restrictions

Since the USDA rural home loans is actually required just for reduced so you can moderate money houses, there are specific money limits positioned in order qualify. To help you be eligible for a USDA mortgage, your general annual household income must not meet or exceed 115% of the mediocre median income for this version of urban area. Based on where you stand choosing to purchase your house, income restrictions tends to be highest or all the way down according to that certain area’s average median money. Such as for instance, when you’re choosing to get a beneficial USDA qualified assets in The brand new Jersey the money limitation is pretty much across-the-board set at $91,five-hundred. To own a complete variety of USDA eligible areas, in addition to their money constraints you can travel to it hook up otherwise contact our financing representatives here at 7th Top Financial.

Due to the fact potential customer have receive a beneficial USDA eligible possessions, the house or property need meet certain USDA mortgage criteria, overall these specifications are the same for all government covered financing. All the attributes need to be small in the wild and you may satisfy the establish requirements imposed by State and you may local governments.

Typically, seventh Level Mortgage might help people borrower with credit ratings out of 620 otherwise greatest qualify for a good USDA mortgage inside the The fresh Jersey, New york, Pennsylvania, Virginia, Maryland, Colorado, Florida, Texas and you can Kansas. When you have good credit which have slight credit blips right here and there we would be capable of geting you qualified, all you need to create is actually get in touch with our representatives or complete the contact form lower than in order to discover.

USDA Loan Refinance Solution

If you have already received a lot into the an effective USDA home loan, you might be surprised to understand that you can buy a level ideal deal into a beneficial USDA refinance loan. USDA re-finance fund are merely entitled to current USDA loans and you will are often easy and quick without property review. You can find some other refinance money readily available plus streamline and you will low-streamline refinance funds, with many finance requiring zero household assessment while some allowing you to finance your closing costs toward overall dominant of your mortgage. And something of the finest pieces about USDA refinance fund are which they be certain that the new USDA financing can lead to an excellent straight down monthly homeloan payment than you may be spending today.

Note: Because of the submitting the request, your grant permission to possess 7th Top Mortgage to make contact with your by the email or from the cell phone.