Midwest BankCentre keeps more than 110 several years of sense providing St. Louis companies https://paydayloanalabama.com/hillsboro/ visited their potential and you will develop their commercial assets out of a trusted commercial lender. We have the products to simply help your online business flourish.

As one of the largest people financial institutions in the St. Louis, we know the potential plus the pressures up against your online business.

Commercial Finance

I build designed financial ways to satisfy the industrial mortgage loan’s criteria. As well as, whenever need develop out of the blue, our very own bankers try energized to behave easily and you may assists fast team mortgage conclusion, a key advantage for prompt-moving businesses and you can marketplaces selecting a fast commercial assets financing.

- Revolving Lines of credit

- Equipment fund

- Order and you can/or expansion financing

Commercial Real estate Credit

Out-of St. Louis Town to St. Charles County to help you Jefferson State and you may everywhere in-between, we could make it easier to help make your sight playing with industrial real estate fund.

Whether you are trying to develop, move in, or re-finance, we provide a variety of customizable real estate money so you can allow you to get the best industrial mortgage into the best terminology to suit your needs.

- Land purchase financing – get a home to create or grow your company

- Construction money – i’ve many selections so your eyes could become a real possibility

- Mini-perms – we provide typical-identity capital options with unequaled independence getting refinancing and you will/or acquiring commercial characteristics

Yes, small businesses is also qualify for commercial loans. Loan providers promote certain funding alternatives customized toward requires out of quick enterprises, for example Small company Administration (SBA) loans and you will providers personal lines of credit. In order to meet the requirements, small businesses typically need to have demostrated a steady credit history, provide appropriate financial statements, present a solid business plan, and show the capability to repay the mortgage.

Small company Finance and you will Personal lines of credit

Whether you really need to financing gains, protection time openings into the earnings, buy gadgets, otherwise make clear their vendor repayments, Midwest BankCentre has the benefit of a number of options to invest in your commercial mortgage loans to fit the different demands of one’s team.

We can offer you a number of rate of interest choice, cost terms and conditions, and credit wide variety. Our very own mission would be to know your position and also to customize an excellent credit tool to fit your team criteria eg providing a keen SBA loan.

- Industrial Line of credit – revolving line of credit which allows one obtain short-label financing as required and you will pay back given that fund getting readily available

- Name Money – loans the purchase out of a particular house, such as for instance an article of products otherwise a building

- SBA (Home business Management) Financing – offered to finance short-label working capital demands instance a corporate credit line otherwise longer-label fixed loans

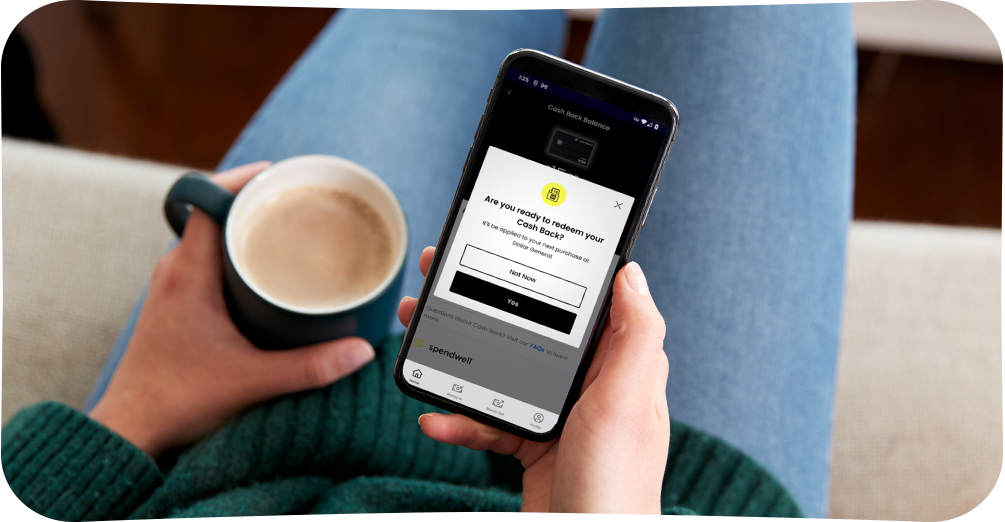

Midwest BankCentre Playing cards

Our notes was tailored towards organizations needs, made to help increase the method of getting financing , keep track of your own organizations expenditures, and gives the latest purchasing stamina your have earned, most of the and will be offering the local, amicable provider you’ve visited anticipate off all of us.

Industrial and you may industrial lending, otherwise C&We financing, is simply one loan granted to a debtor that’s an effective business and never a single. C&I loans give fund to possess resource expenditures, working capital, and other business investment criteria.

Whenever applying for a commercial loan, lenders think numerous factors to measure the creditworthiness of your borrower and also the stability of the organization. These issues include the borrower’s credit rating, business economic comments, earnings forecasts, security well worth, globe data, and the aim of the mortgage. Lenders in addition to gauge the borrower’s experience and you may management prospective to choose their capability to settle the borrowed funds.

C&We Loan Collection on Midwest BankCentre

Midwest BankCentre also provides Industrial and you can Industrial Loans creating within $five-hundred,000. The C&I loan portfolio include all sorts of funds and additionally:

Treasury Government Choices

The versatile, personalized treasury government properties , also known as cash government , make it easier to as operator clarify economic procedures, would income , and you will maximize earnings. Despite their commercial banking demands, we will help discover the very cost-effective selection by examining financial passion and you can sharing alternatives to suit your business earnings .

Our Sweep Service optimizes the usage of financing in the market examining accounts from the wearing restrict attention and you may/or cutting personal debt because of the automating transmits between profile . All of our Secluded Deposit Need option provides you with the genuine convenience of and also make deposits from your dining table – in addition to Mobile Places from your own cellular phone or tablet – searching loans less and capitalizing on afterwards put due dates.

You always get access to Online businesses Financial to know their bucks standing, obtain genuine-big date study, make ends meet online, examine back and front pictures from inspections and you can deposits, down load suggestions into the a common system particularly QuickBooks, discovered comments and you may observes digitally, and you can accessibility Bill Pay services to spend bills from your own computer otherwise mobile device the new small, effortless, and you can paperless method.

Regional Lockbox Running is obtainable to attenuate employee work and you may drift. Lockbox running collects costs in the a safe opportinity for automatic same-go out dumps playing with good St. Louis P.O. Field address. And now we has ACH Origination making direct deposits (along with payroll), gather automatic money out of customers, and focus bucks (even from the aside-of-condition towns and cities).

The Re also$ubmitIt Take a look at Recuperation Service enables you to improve and you will speed up the latest range off returned monitors and lower collection standards. And you may the Con & Defense Safety reduce the risks of electronic scam thru ACH prevents and strain to protect up against examine swindle using confident shell out and membership reconciliation because of the showing outstanding inspections, an such like.

Industrial financing means funds provided to businesses or some one to possess commercial aim, such as for example getting industrial attributes, financial support organization expansions, or to find devices. Home-based financing, at exactly the same time, is targeted on fund for purchasing or refinancing residential propertiesmercial financing comes to more complicated underwriting procedure, high loan number, as well as other chance examination in accordance with the monetary show of one’s providers otherwise commercial possessions.