Very, you’ve been contemplating delivering property collateral loan, huh? Well, congratulations towards the delivering one step toward unlocking the potential on the domestic! Be it to have home improvements, debt consolidating, if not a significantly-required vacation, a property security loan would be an economic lifeline. Before you sign on this new dotted line and start daydreaming concerning your future arrangements, it is important to understand the ins and outs of household collateral loan payments.

After all, you do not want one shocks afterwards whenit comes to repaying your loan. So, let us plunge right in and you can explore all you need to see in the the individuals costs as well as how they work.

What’s a property Collateral Loan?

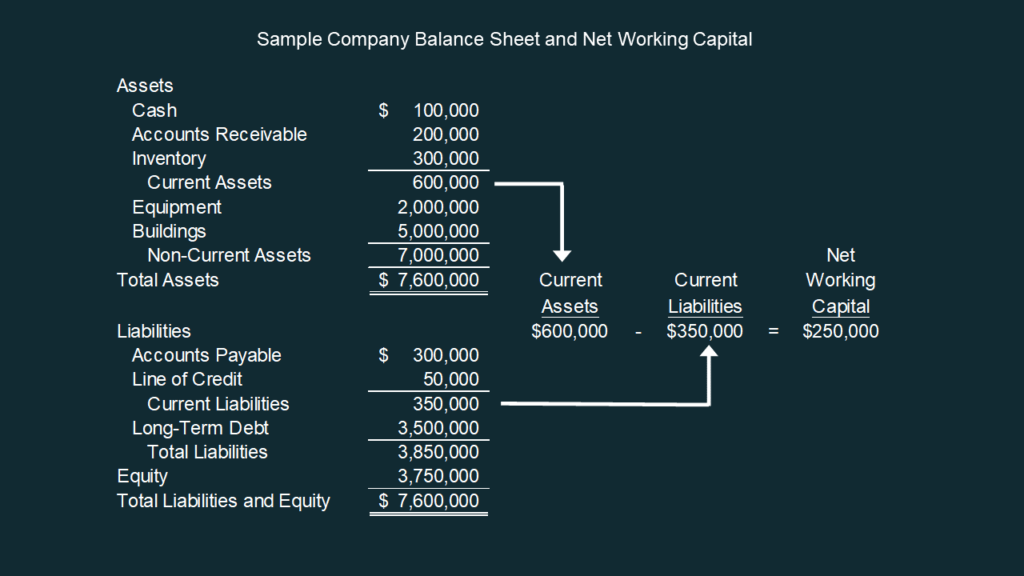

A house security loan is a type of mortgage that allows property owners so you’re able to borrow money through its home’s collateral since the equity. Security is the difference in the present day property value the house while the balance due on the home loan. Which have a home security mortgage, consumers located a lump sum payment of money and you can typically repay it more a fixed period which have repaired monthly payments.

These money give homeowners the ability to supply funds for various intentions, eg home renovations, combining financial obligation, otherwise layer unforeseen costs. The total amount consumers is use will be based upon points for instance the residence’s appraised worthy of in addition to their creditworthiness.

Just how Domestic Security Loan Money Functions

Household equity loan money performs by allowing individuals to settle the fresh amount borrowed, also appeal, more a specified label. These types of payments can be produced in another way according to financing agreement. Some individuals choose principal and you can attention costs, where both mortgage equilibrium and you can focus is gradually paid off. Other people will get favor desire-just repayments, where only the attention was paid off initially. Balloon costs, in which a huge sum try paid down at the conclusion of the fresh new title, are an option.

Prominent and Attention Money

Dominating and you can appeal money try a crucial aspect of house guarantee loan repayments. The primary ‘s the 1st loan amount, due to the fact attention ‘s the cost of borrowing. Each fee generally has area of the dominant and you may accrued focus.

For example, for those who have an excellent $50,000 household equity loan with a 5% interest rate, your payment per month is certainly going towards reducing the principal balance and you may covering the attract fees. Throughout the years, as you help make your costs, the fresh new ratio spent on the primary gradually develops, reducing your complete debt.

Understanding how principal and you will attention payments functions helps you finances effortlessly and you may track your progress in the paying the borrowed funds. It is essential to remark your loan arrangement, which will outline exactly how your instalments is allocated and exactly how it effect the loan harmony.

Interest-Just Payments

Some household guarantee money give you the option of while making appeal-just payments having a certain several months, typically 5-ten years. During this period, consumers only pay the interest accumulated into the amount borrowed, in the place of decreasing the principal harmony. Although this provide down monthly premiums first, you should comprehend the ramifications.

Because of the choosing attract-just costs, property owners delay repaying its personal debt, meaning that they may deal with higher repayments later on in the event that dominating money start working. This tactic they can be handy for these having quick-label economic goals otherwise short term cash flow limitations. Although not, its critical for consumers having an idea in position to deal with the main repayments when they started owed. Otherwise, it risk facing economic challenges if not foreclosures.

Balloon Costs

Balloon money try a variety of family security mortgage payment construction in which a huge part of the dominant arrives in the stop of your own mortgage name. That it fee should be significant and you may hook borrowers off guard in the event the they may not be prepared. It is important to carefully imagine if or not a great loans Cherry Creek CO balloon payment arrangement suits your debts and you can coming agreements. Neglecting to make this percentage may cause the possibility of foreclosure otherwise being required to re-finance the loan.