A beneficial conditionally accepted financial mode the mortgage financial will agree your loan app, assuming you see particular standards. Conditional approval out of a mortgage loan will not ensure final acceptance, but it is one step past prequalification you to indicators a robust options out of recognition.

Because of the reaching the conditional recognition stage inside the financial underwriting, you almost certainly already supplied high information and you can met of a lot standards. Keep reading to understand conditionally acknowledged mortgage loans and acceptance conditions your may prefer to see.

- Wisdom Conditionally Accepted Financial

- Popular Acceptance Conditions

- Financial Data

- Come across All of the 17 Activities

Insights Conditionally Recognized Financial

After you sign up for a home loan, the financial institution can begin the latest underwriting technique to certify your provided advice, as well as your credit score, earnings and you can personal debt advice.

Conditionally accepted form the fresh new underwriting process is done, and your mortgage will be recognized if you see particular requirements. Preapproval was a primary acceptance or guess from offered loan numbers and you will will not imply that the new underwriting procedure is complete. Conditional recognition shows that this new underwriting process is complete, and you just need certainly to meet most standards.

Though you happen to be conditionally recognized, this doesn’t mean your mortgage is actually safeguarded otherwise has received final approval. If you cannot finish the lender’s conditions otherwise has actually almost every other facts occur, your property mortgage could still be denied.

Common Recognition Standards

Should you get a great conditional financial approval, the lender will identify extra issues that must be fulfilled. Read on to possess prominent approval standards and exactly what you will have to do in order to satisfy approval criteria.

Financial Data files

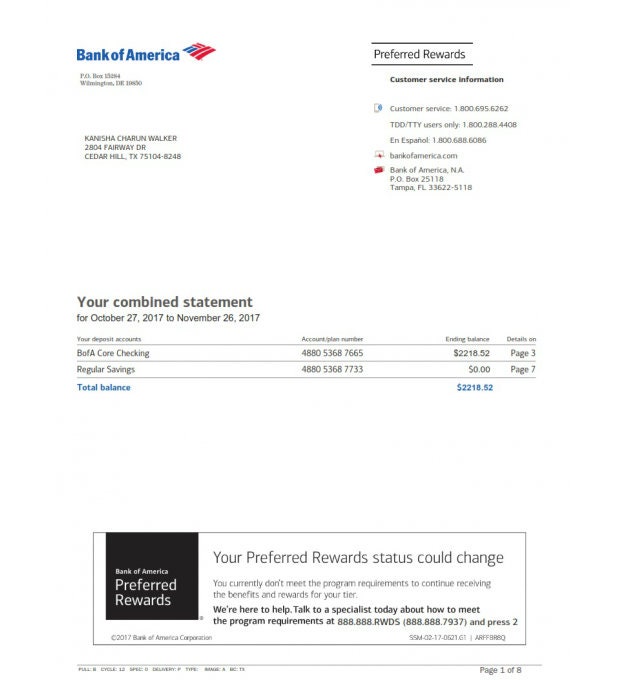

Either loan providers will require even more verification off monetary details, even though you currently supplied economic confirmation. Including, their lender you’ll demand even more financial data for example resource account information, bank statements, tax statements or any other paperwork confirming your income.

More Documentation

Their financial may require significantly more documentation to get to know mortgage conditions otherwise criteria, out of verification out of financial records so you’re able to gift letters otherwise emails away from reasons.

Letter out of Need

Within the underwriting processes, the newest underwriters look at all of the financial deal. If you have generated a big detachment otherwise obtained a big financial provide into the deposit, you may need to deliver the financial that have a page regarding explanation. This letter is always to detail just what detachment are to own, or in the actual situation regarding a gift, something special page.

Home insurance

For people who haven’t yet shielded otherwise given verification regarding homeowner’s insurance coverage, your financial get demand documentation which you have ordered a home owners insurance toward property.

Current Emails

Loan providers will need a present letter for any gift of money to possess the loan. The fresh new page try a created declaration guaranteeing one loans received for a down-payment is actually a gift in the place of financing.

The newest letter must determine where in fact the gifter’s money are arriving out of plus the relationships amongst the gifter therefore the recipient

Household Standards

When the discover family-related fine print, including bringing a home assessment or appraisal, the lender might need files which you have fulfilled every domestic standing verification criteria. This may involve brand new assessment and you may homeowners insurance.

Other kinds of Mortgage Approval

Whenever making an application for home financing, you may want to come across a few brand of acceptance till the final intimate. Here are most other level regarding home loan approval you could potentially pick.

Prequalification

Home financing prequalification is actually a variety of initially or estimated approval https://paydayloansconnecticut.com/old-saybrook-center/ that isn’t as near to help you approval because the good conditional recognition. A home loan prequalification mode the lending company has many very first details about both you and has furnished a quote of your loan amount you you’ll qualify for.

Preapproval

A mortgage preapproval is but one step beyond prequalification and mode you have submitted specific pointers to your bank. During this period, the lender probably enjoys pulled your credit score. Home loan prequalification provides you with a far greater notion of how much you are able when house browse, however, an underwriter however has never verified the latest loan’s economic facts.

Formal Acceptance

Official approval setting you’ve been recognized to close off to your assets. The fresh new underwriter possess verified your credit report, bank account and you will money advice. You may discover a formal acceptance letter showing into the seller’s real estate agent and you can plan the latest closure.

Approval to close

Approval to shut ‘s the last phase out-of financial acceptance. After you have put a romantic date to close off on household and acquired brand new official recognition of the mortgage from the lender, you’ll receive the approval to close. It generally try given on closing when the documents for the label transfer is ready to be signed.

Enough time figure regarding conditional approval in order to latest approval varies established towards the factors book every single applicant. For example, the difficulty of your situation as well as how rapidly you could see the brand new conditions may affect closure speed. They will take a short time to a few days.

What goes on otherwise Meet the Standards to have Last Recognition?

Their mortgage will getting refuted or even meet with the final recognition requirements. At exactly the same time, you may be declined for assorted explanations, including:

- You have taken into the latest loans

- Unproven economic data files

- You decided not to meet the financing standards because of the the deadlines

- The home has actually an effective lien

- Our home appraisal is actually too lower

Even if the conditional acceptance drops thanks to, you can keep in touch with your loan administrator, just who might be able to recommend a resolution to meet mortgage standards. Otherwise meet the requirements to possess latest approval, you can reapply for the existing or see a separate financial.

Protecting The Mortgage Recognition

If you were conditionally accepted to possess a mortgage, you might be alongside buying your dream household. Follow up which have people requirements and become when you look at the close contact with the mortgage lender to get rid of any delays. Prepared to start off? Find some of the finest mortgage lenders right here.