The fresh new USDA Outlying Advancement Mortgage is obtainable so you can qualified rural people who aren’t able to receive capital regarding antique sources. These types of loans are just like ranch proprietor fund, nevertheless they provides multiple secret differences. Read on to understand exactly what an excellent USDA Outlying Advancement Home loan is just in case it is for your requirements.

What’s the USDA Rural Innovation Financial?

This new USDA Outlying Development Home loan are a government-covered loan that provides capital to own outlying housing. The application can be found to help you eligible rural residents-besides growers-who satisfy income and you will borrowing conditions. The loan provides resource to the get or refinancing off good house and certainly will be studied getting home improvements.

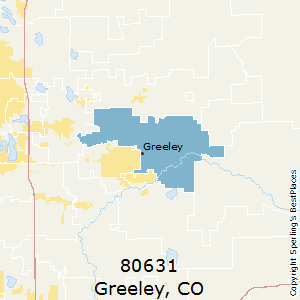

The new USDA Rural Advancement Financial system was given of the Us Department regarding Agriculture Rural Invention (USDA RD) work environment. The application form comes in all of the fifty states, Puerto Rico, as well as the All of us Virgin Islands. Interested people have to get in touch with their regional USDA RD office to choose qualification and apply towards the financing.

New USDA Rural Development Financial program even offers many perks so you can eligible borrowers, and low interest rates, zero downpayment conditions, and flexible conditions. The borrowed funds try covered because of the Us regulators, and that covers the lender if there is debtor standard. Additionally, the brand new USDA RD Financial system now offers multiple investment choice one https://paydayloancolorado.net/ken-caryl/ to can be designed to meet up with the requirements of per debtor.

The fresh new USDA Outlying Creativity Financial system is a fantastic option for outlying homeowners who’re shopping for affordable money.

Qualification to own USDA Outlying Invention Lenders

Are qualified to receive an excellent USDA Outlying Invention Home loan , the house have to be based in a qualified outlying town. New borrower should fulfill earnings and you can borrowing criteria. The mortgage conditions are generally for 30 years, that have a predetermined interest. Most other conditions are:

- You truly must be a good U.S. resident or permanent resident alien.

- You really need to have courtroom capacity to enter a binding offer.

- You truly must be 18 yrs . old otherwise old.

- No one should feel frozen or debarred regarding involvement from inside the federal software.

- You should not was basically convicted out of a life threatening offense.

- You must have adequate and you can reliable money to cover the homes expenses along with other expense and you can personal debt.

- Your credit report have to be sufficient.

- You’ll want a reasonable ability to repay the borrowed funds.

- The house or property you wish to pick should be inside the a qualified rural urban area.

If you satisfy all of the significantly more than criteria, you ent Financial. Get in touch with a city USDA work environment more resources for such financing and ways to apply for you to.

The advantages of USDA Rural Creativity Lenders

There are many positive points to USDA Outlying Creativity Mortgage brokers. Possibly the greatest benefit is the fact these financing might help you get a property with no down-payment. Consumers is discover as much as 102% resource of price, which can help which have closing costs. and no personal home loan insurance rates (PMI) dependence on accredited individuals.

If you’re looking to buy your basic home, a great USDA financing can give you the chance to carry out therefore with very little out-of-pocket debts. Of course, if you already own a home, a good USDA mortgage can be used to re-finance the home loan and you may probably save some costs per month in your money.

An excellent benefit of USDA Outlying Creativity Mortgage brokers is that they offer flexible installment options. You could potentially will pay back your loan during a period of three decades, you can also opt for a shorter cost label of fifteen decades. That it self-reliance makes USDA finance a nice-looking option for of numerous consumers.

If you are searching getting a home loan having great features and you may versatile installment choice, a beneficial USDA Outlying Innovation Financial is good for you.

The difference between this new USDA Rural Creativity Financial and Ranch Manager Fund

There are lots of key differences when considering new USDA Rural Invention Financial and you will farm owner money. For example, farm manager finance are only open to producers just who own the individual homes. Consequently when you’re leasing home or dont own the house outright, you will not qualify for this type of financing.

Likewise, farm owner money typically have high interest rates than simply mortgage brokers because they’re even more risky. Ranch holder fund typically have faster installment conditions, you must be ready to create your repayments timely each month.

A new key difference in the fresh USDA Outlying Creativity Financial and you can ranch holder financing is the fact that the former can be used to purchase a first home, given that latter can simply be employed to get farmland.

If you are considering both of these sort of money, make sure you talk to financing manager to determine what one could become best for your unique state.

How to start off with a USDA Outlying Invention Mortgage

If you’re looking purchasing property inside the an outlying urban area, good USDA Rural Advancement Mortgage might be an effective choice. USDA loans are around for parents with lower income and certainly will assist them to get into a more affordable home.

Getting started off with good USDA mortgage is not difficult. The initial step would be to get hold of your local USDA place of work and you will enquire about the financing apps. After you’ve come approved for a loan, you will have to discover a playing financial.

After you have found an acting financial, you’ll need to submit an application and gives some elementary information about oneself plus money. The lending company will then remark the job and determine into whether to help you approve you for a loan. When you’re accepted, you’ll be able to score financing which covers the acquisition price of your property, along with people needed fixes or renovations.

When you are selecting getting a good USDA Outlying Creativity Financial, the process is basic to adhere to. With some browse and lots of determination, you can be on your journey to purchasing your house immediately.

If you are an outlying citizen that is looking examining the funding possibilities, contact your local USDA outlying innovation office otherwise a medication financial in the Financial Concepts Home loan during the Oklahoma Urban area. They may be able make it easier to determine if youre eligible for which program and you may explain the fine print. Start now!