Table out-of Information

- What is a compliant Mortgage?

- What exactly is a compliant Mortgage?

- What is the Difference in Conforming and Conventional Financing?

- What is the Traditional Conforming Financing Limit?

- Takeaways

- Offer

REtipster does not promote taxation, capital, or monetary information. Constantly seek the help of a licensed financial professional prior to taking action.

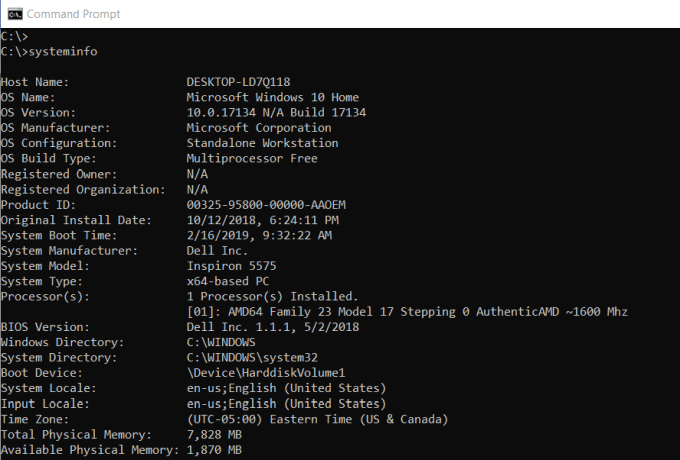

What exactly is a conforming Home loan?

- Fannie mae and you can Freddie Mac’s assistance having financial support solitary-nearest and dearest home.

- This new Federal Construction Financing Company (FHFA) sets the borrowed funds limitations.

Fannie mae and you can Freddie Mac incentivize loan providers exactly who obey its rules by buying your house finance they topic. This type of government-sponsored companies (GSEs) repackage brand new mortgage loans towards the securities market these to buyers. Compliment of such GSEs, compliant loan lenders can certainly expand credit so you can homeowners and get mortgage loans off their equilibrium sheets.

- The mortgage must not exceed new money cap set by the government on county the spot where the house is discover.

Differences With a Nonconforming Home loan

At the same time, nonconforming mortgage loans keeps different degree conditions while they go beyond the mortgage limits set of the FHFA. That’s why nonconforming lenders including pass the name jumbo mortgage loans.

As a result of the count, nonconforming finance are way too large to own Fannie mae and you may Freddie Mac computer to buy. With no backing regarding GSEs, nonconforming lenders was encouraged to charge highest interest rates and also make right up to your greater risk prepaid debit card payday loans online they want to get.

Conforming fund and you will antique fund are a couple of more terms. For just one, all compliant mortgage loans is actually conventional, although not most of the antique mortgages are compliant.

Due to the fact Fannie mae and you may Freddie Mac computer was theoretically private companies, whether or not it way to the fresh new FHFA, one loan they right back is a traditional loan.

In fact, nonconforming mortgages is actually antique money on their own given that zero third party set the brand new certification guidance for these home loans. Lenders-which can be individual organizations-by yourself label the new images. Capable lend up to they want and also to whoever they need.

Was an FHA Mortgage a conforming Mortgage?

If you find yourself FHA and you will conforming mortgages dont fall into a similar group, both of them may help American consumers, particularly millennials, defeat some of the typical obstacles to possessing a property.

Far more millennials commonly like compliant mortgages more FHA of these. One of several you can easily explanations ‘s the a bit lower down fee requirements conforming lenders features.

Subprime Loan vs. Conforming Loan

An excellent subprime financing is offered in order to people that have a credit rating less than 620. Referring with a high notice to compensate the lending company getting extending borrowing in order to a borrower whoever number implies that the probability of later percentage and you will standard is actually highest.

Because minimal credit history element conforming mortgage loans is actually 620, they could not linked with subprime rates of interest.

Consumers having credit ratings out of 620 otherwise more than could be felt near-prime, best, or very-finest. No matter what category such homebuyers end up in, he is inside a gentle standing in order to discuss for advantageous interest due to the fact a reward for their creditworthiness.

What is the Traditional Conforming Financing Limitation?

Just the right respond to depends on some things: the amount of time of the season additionally the location of the family. The following is a summary of for every factor.

Time of the year

The us government establishes brand new conforming mortgage limits per year with the Family Speed Index. In earlier times, policymakers relied on this new Monthly Interest rate Questionnaire. New FHFA adjusts the most compliant mortgage limits to help you echo the latest improvement in the typical home prices over the United states from the previous seasons.

Which federal agency announces the fresh new financing ceilings on 4th quarter of the most recent season centered on household costs for this new earlier in the day five house.

The initial you to definitely applies to the You.S., whereas the second reason is reserved for look for areas or county-equivalents, especially in areas where your local average family value is actually highest as compared to baseline limitation by the 115%.

Venue

The threshold of your own conforming financing restrictions within the expensive section try 150% of standard limit. Your house funds awarded making use of the large limit restrict appropriately is actually titled very compliant money.

Because of the specifications in Homes and Financial Recuperation Act out of 2008, Alaska, Their state, Guam, therefore the U.S. Virgin Isles stick to the large restrict conforming amount borrowed cap.

In addition, the newest conforming mortgage constraints can increase otherwise decrease. Capable in addition to stagnate, like how it happened out-of 2006 in order to 2016 if the baseline limitations having single- and you may multi-equipment properties stayed undamaged at $417,000.

If conforming mortgage ceilings are likely to dive, specific loan providers actually start to agree large loan applications through to the federal agencies helps make a proper statement.