Domestic equity funds will let you borrow cash utilising the collateral of your property, providing you with fast access to help you versatile fund. Making use of your own house’s security makes you score bucks one to you are able to to remodel your home, combine expenses, safety high costs, plus.

At Griffin Capital, we make it simple to submit an application for a house equity mortgage in the Maine and provide aggressive interest levels. Find out more about Maine family equity financing, the way they performs, and what can be done with these people.

Maine domestic security fund are simple, letting you use your residence’s guarantee due to the fact guarantee when deciding to take out a protected loan. You are able to so it money for nearly things, whether you are aspiring to cover scientific expenditures, pay money for school, otherwise loans domestic renovations to increase the value of your residence.

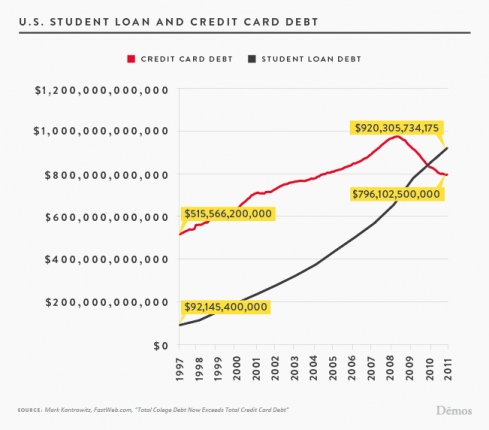

Domestic guarantee loan rates from inside the Maine are usually lower than borrowing from the bank notes and personal funds. Inside sense, a house collateral loan should be the best way to combine established debts, and that means you just need to create a single percentage on a potentially down price.

Their bank look at equity of your house to see whether you may be eligible for financing and you will assess cash advance in Jemison the borrowed funds number. Usually, loan providers can help you acquire to 95 per cent out-of the fresh new collateral of your house, with some loan providers mode the fresh new limitation on 85 %.

Making an application for a house guarantee mortgage when you look at the Maine is relatively easy, you need certainly to render W-2s and tax statements usually. When you’re a self-operating debtor otherwise advantages from strange earnings streams, we provide a zero doctor house security financing also.

Form of Family Guarantee Finance

You can find essentially a few collection of sorts of family guarantee funds that you might pull out: a basic house equity loan (HELOAN) and a house collateral line of credit (HELOC).

A property security personal line of credit is exactly what it may sound such as for example – a personal line of credit that utilizes their house’s security given that collateral. Your financial gives you a having to pay restriction in accordance with the value of your house and how much security you may have. HELOC pricing in Maine and your purchasing can differ per month, that may end up in contradictory monthly payments. However, you could potentially basically utilize this personal line of credit such as you would explore a credit card.

House collateral funds was a tad bit more quick, letting you borrow a lump sum payment that have a predetermined mortgage label that is always ranging from five and 40 years. Home security financing rates inside Maine was fixed, so you’ll be able to improve exact same commission monthly.

Before applying to own property security loan in Maine, weigh your options to find out hence mortgage variety of is useful to you personally.

Positives and negatives from Maine Household Equity Funds

Along with having the ability a house equity financing work , you will be aware advantages and disadvantages. There are some benefits of using Maine domestic collateral funds, however, you will find some potential risks that each debtor are going to be alert to.

- You can rapidly accessibility income that might never be available otherwise

- Griffin Funding offers competitive prices toward house equity money within the Maine

- You don’t have to call it quits the low-rates first-mortgage

- Your property guarantee mortgage can be used for from medical expenses to help you home improvements

- HELOCs can lead to overspending otherwise carefully manage your profit

- You can eliminate your property if you aren’t in a position to repay your residence security financing

- Taking right out a great HELOAN or HELOC adds to your own overall obligations weight

You will discover disadvantages to take on, it all depends on your own financial predicament. Very carefully consider your possibilities prior to people biggest financial decisions.

Maine Family Collateral Financing Qualification Criteria

Its crucial to make sure you see family equity loan certification conditions before applying. You don’t just need collateral of your house – you should let you know loan providers you could potentially repay the loan. Here you will find the well-known requirements for Maine household security finance:

- You’ll want about 20 percent collateral of your property to be eligible for extremely funds. Particular loan providers could possibly get allows you to qualify for financing that have only 15 percent equity of your house.

- Lenders will at your credit rating and you can personal debt-to-earnings proportion inside app processes. If you have extreme loans otherwise a decreased credit history, you could potentially monitor your own borrowing from the bank and begin repaying the debt before applying.

- Their mortgage payment background and you will money also are techniques. We should make sure you is pay-off the loan, therefore we have a look at to make sure you also provide proof of income and you can a track record of and then make for the-time mortgage repayments.

If you aren’t yes if your qualify for a property guarantee loan within the Maine, feel free to reach out to me to discuss your own qualifications. You can even download the latest Griffin Gold application , which is an extensive investment that allows one compare mortgage options, manage a budget, look at the credit score, tune the residence’s value, and much more.

Sign up for a home Equity Financing from inside the Maine

Facts the loan choices makes it possible to safer most useful mortgage terms and conditions. Having property collateral mortgage from inside the Maine, you could potentially efficiently combine debt or score dollars to cover biggest expenses. We provide aggressive Maine house security mortgage pricing which will help you earn the most out of this new equity you generated on a primary home, next home, otherwise investment house.

If you’re considering tapping into their home’s collateral and you may taking out fully good HELOAN otherwise HELOC, we’re here to greatly help. Griffin Funding now offers competitive costs and you will an easy on line application procedure. Happy to sign up for that loan? Fill out an application on the web otherwise contact us to apply for a house collateral financing today.