0.5% to a single.5%), property owners that have traditional money will quit PMI money when they arrived at 20% control. USDA individuals, at the same time, spend 0.35% until the mortgage is paid.

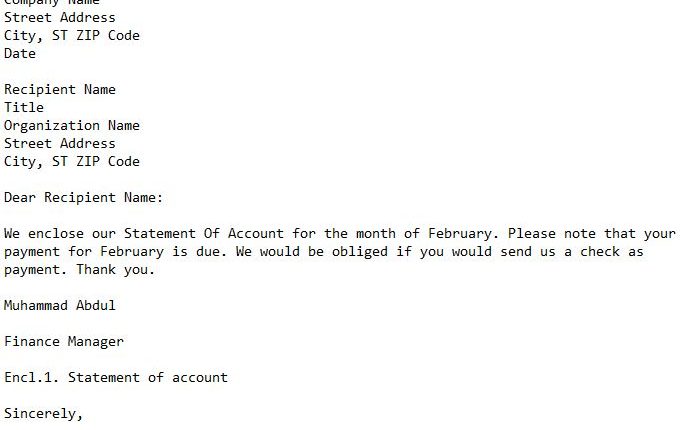

Historical chart regarding USDA financing pricing

Usually, 30-year, repaired costs to have USDA fund keeps accompanied traditional financing cost most directly. Which means they plummeted during the pandemic, hovered doing step three% because Government Put aside attempted slowing new discount, and now have as the risen to good healthy

Though cost for USDA and conventional financing rose within the 2024, positives expect a great cooling-off period throughout the 2025. Between the Mortgage Bankers Organization and Fannie mae in itself, regulators in the area tend to concur that prices getting traditional mortgage loans will hover up to 6% all year round.

However, falling prices are not fundamentally a huge yellow end suggesting to attend. There can be so much more competition/reduced catalog whenever prices get rid of, and buying in the course of time setting building security ultimately. Part is actually, there are those facts one gamble to the when to get conversation, therefore the better person to help you to get new timing best is your bank.

Speaking of lenders, you must know not folk also offers USDA money. So how do you select a loan provider one do?

Banks offering USDA lenders

Let us basic distinguish ranging from USDA head money, that are provided personally by the government service, and USDA secured financing, which can be supported by the us government however, issued from the a personal bank.

If you’re looking into the former, it is possible to glance at the local Outlying Invention Provider Heart. But if you need the greater number of popular secured mortgage, it is possible to look for a personal financial instance a lender otherwise borrowing from the bank union.

While making something easy, brand new USDA keeps a complete a number of Active Loan providers with recently began USDA financing. At the time of this creating the list is within the location from 185 solid, so you should enjoys several choices for your state.

In order to favor, think one to faster lenders are far more nimble and you may receptive than larger banking companies. And additionally, like many real estate professionals, local lenders have a tendency to performs prolonged instances outside of a frequent 9-5 to discover the business complete that assist your personal on time.

Even though it indeed does not harm to start a premier-level conversation with a loan provider with this listing, one of the recommended ways to find the correct financial getting you is to wade old-school: simply ask your Realtor otherwise a fellow debtor getting a referral.

The fresh takeaway

USDA financial costs commonly constantly slide below conventional household pricing, and you will surprisingly, you can find of numerous USDA-eligible qualities in outlying components and you will significant suburbs.

You can find cons to USDA financing, without a doubt-he has earnings hats, possibly large closing costs and you can an excellent ensure payment you do not avoid expenses-however, on the whole, the benefits commonly surpass brand new cons for some consumers.

So if you’re interested in land inside the an outlying or suburban urban area, it’s worthy of connecting that have a realtor and you will/or lender to discuss the options.

Frequently asked questions

If you are looking to live in an outlying otherwise suburban city, you’ve got decent credit (good 640+ score) therefore usually do not make more than 115% the average household money into the areas where you want to, a great https://paydayloanalabama.com/ivalee/ USDA mortgage can be a superior replacement a conventional mortgage as it is also lower your interest rate while wouldn’t be required to offer a down-payment.

not, USDA money can take longer discover approved and to intimate with than many other mortgage loans, so continue you to planned if you find yourself towards the a preliminary schedule.